Leveraging customer data has been the key driver of growth for many of the most successful companies over the past 10 years. Companies like Netflix and Amazon have utilized customer insights to better target their users’ interests, and have done so with such effectiveness that they have grown to become some of the most well-known brands in the world.

Unfortunately, many financial institutions have lagged behind in the adoption of similar technologies and techniques. Without a strong digital presence, it has become more difficult to attract and engage younger audiences.

Kapitalwise seamlessly connects client data to a range of digital engagement tools without any risk to Personally Identifiable Information (PII) Compliance or Customer Privacy.

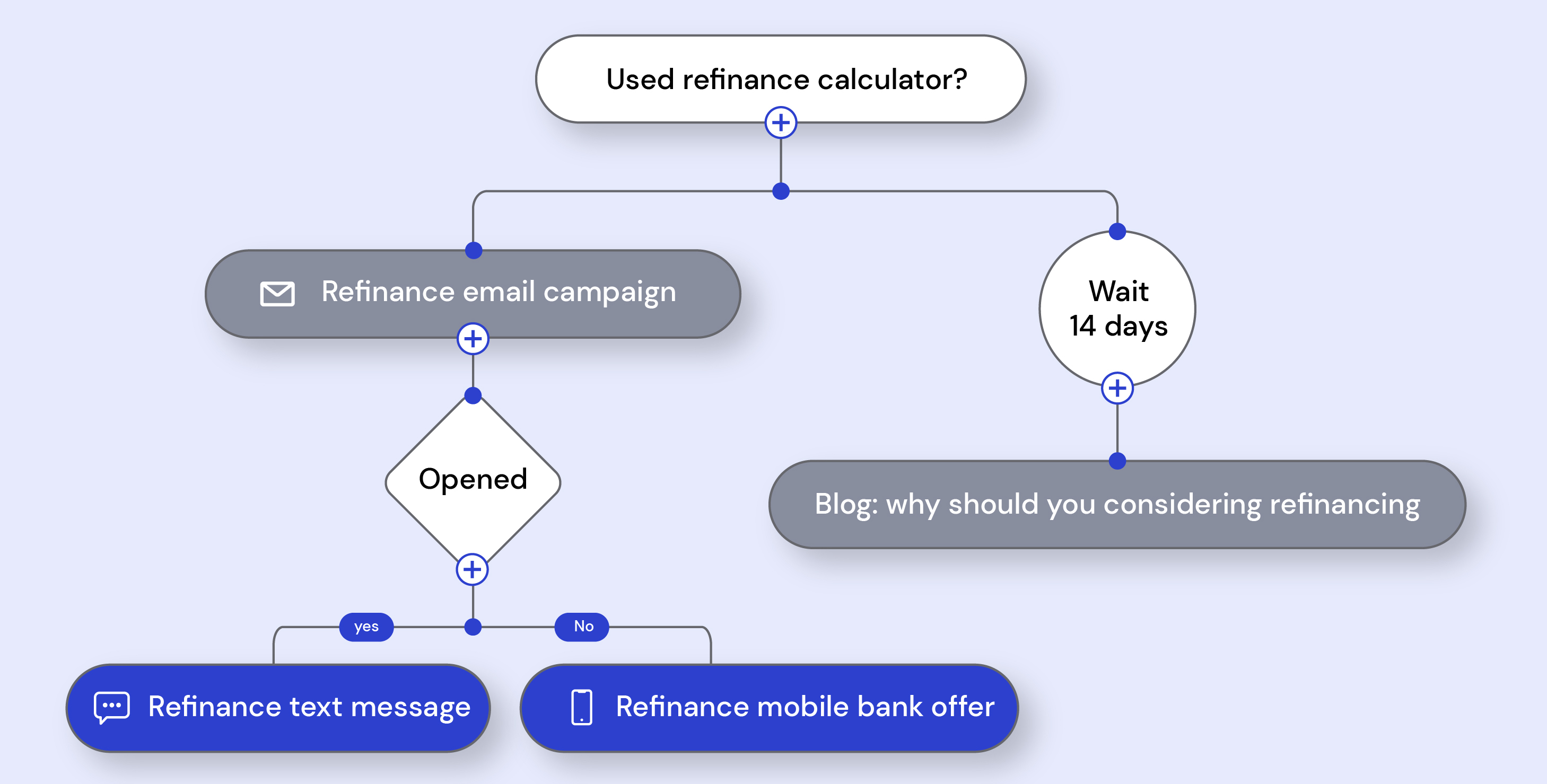

As such, Community Banks and Credit Unions can trust Kapitalwise to identify customer/member “signals” that are tied to a personal record but anonymized and securitized without any data sharing risks. From these anonymized profiles, we can identify changes in lifestyle or upcoming financial needs, allowing us to deploy custom messaging and engagement tools to serve users with offers for their upcoming financial needs at exactly the right time.

Along with our automation, marketing teams can deploy custom campaigns and workflows that require no technical involvement or data science involvement to deploy. Drag and drop tools streamline the process, and all templates are easily shared between departments allowing for collaboration between teams and Compliance departments to quickly edit and approve content.

Along with pre-built templates and content, we enable our partners to compose blogs, offer financial wellness tests, and custom loan calculators which address their customers/members’ needs, and data management and segmentation are simple with no need for manual data pulls, merges, or management.

Better yet, our tools test, measure and evolve over time to show and drive maximum results.